A GST Registration Certificate in Form GST REG-06 is issued to each registered taxpayer. If you are a registered taxpayer, you may also Download GST Certificate from the GST Portal.

As per the GST council, entities with an annual turnover of more than Rs. 40 Lakhs are required to register under the GST. However, entities in special category States must register under the GST when their turnover exceeds Rs. 20 Lakhs. And the composition scheme can be used by a company with a turnover of Rs.1.5 Crores. Goods and Service Tax (GST ) is an indirect tax levied on the supply of goods and services.

Once your GST application is done you will receive an approval mail from GST department stating that the taxpayer GST Registration application has been approved and you can download from gst portal. Downloading the GST Registration Certification is a very simple and easy process.

Steps to be followed To Download GST Certificate from GST portal: Gst.Gov.In

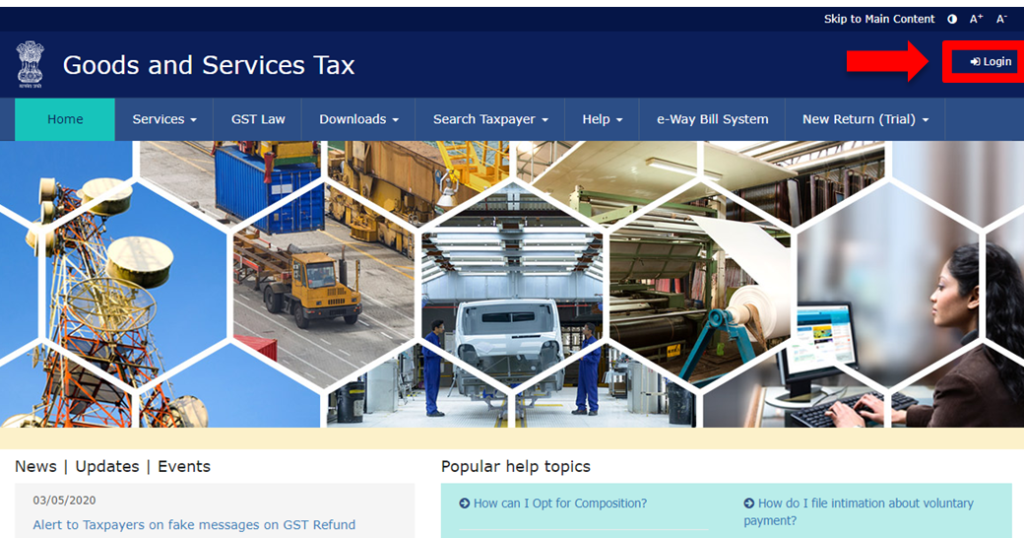

Step 1 : Visit Online GST Portal i.e https://www.gst.gov.in/

Step 2 : Click on Login (On the top right side of the page).

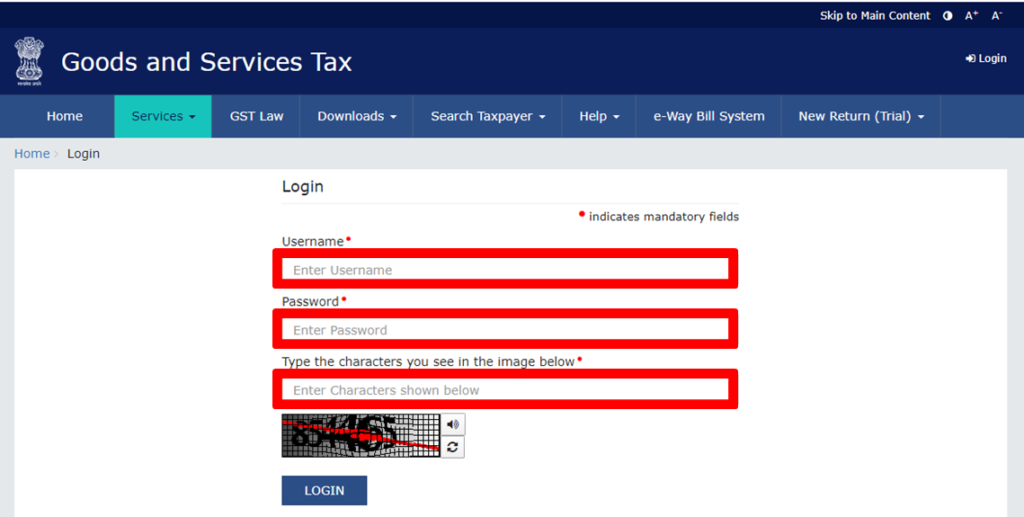

Step 3 : Now Enter your “Username” and “Password”, along with the correct “Captcha” to login.

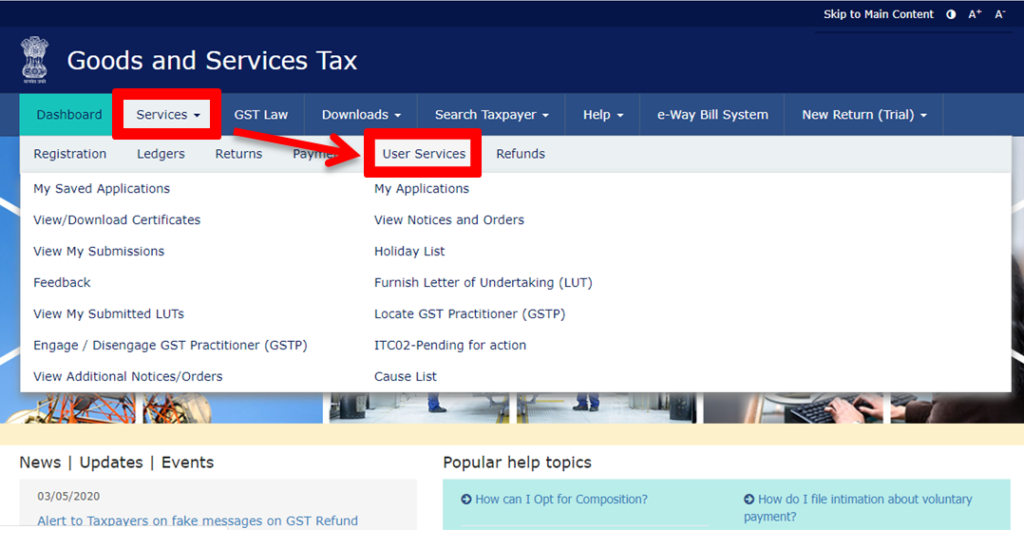

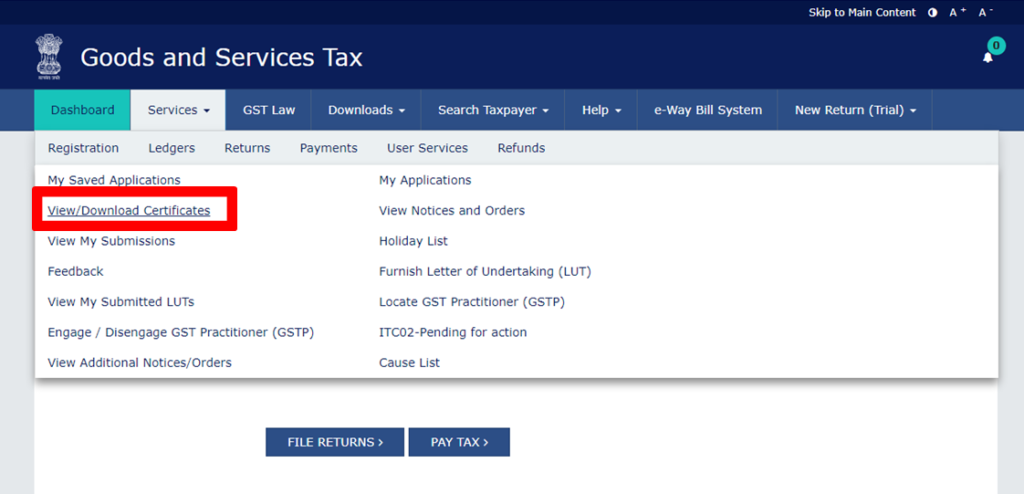

Step 4 : When you login, the GST Portal Dashboard will appear on your screen and Click on “Services” then select “User Services“.

Step 5: In the User Services you will see various options, but you have to Select “View / Download Certificate“.

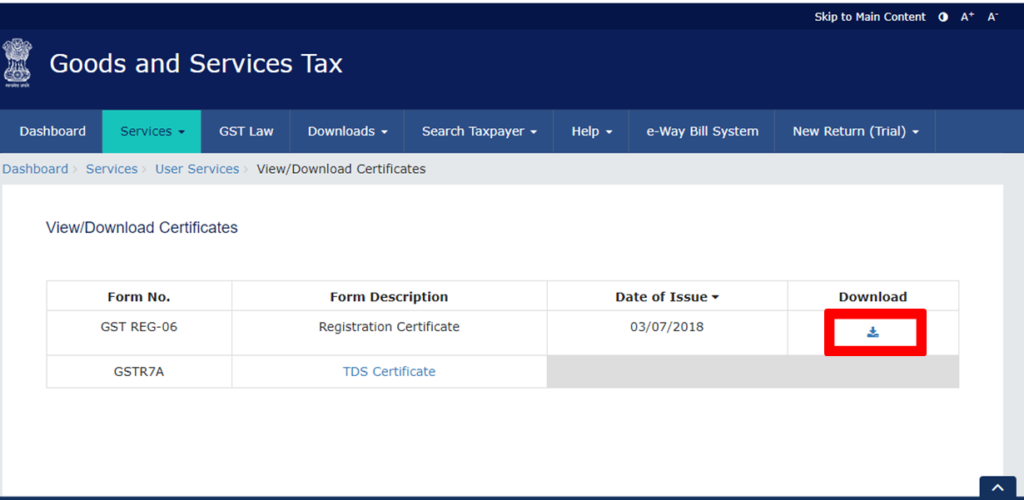

Step 6: Now a table with Form Number, Form Description, Date of Issue and with Download option will be displayed on the screen and Click on “Download”

Step 7: The PDF file will be downloaded in saved location of your system.

Now You can view the Downloaded GST Certificate by opening pdf file and use it according to your need.

Download GST Registration Certificate for new taxpayer

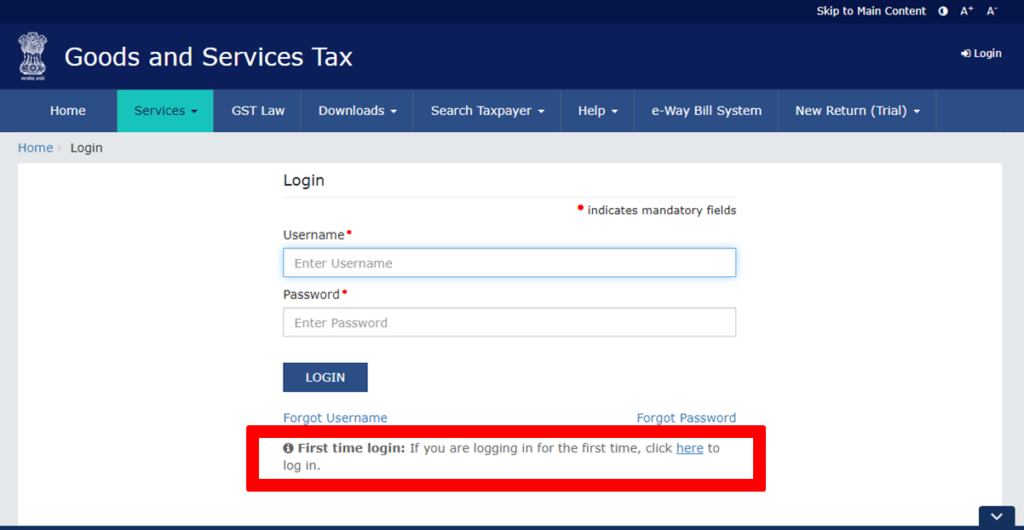

But In case you are a new taxpayer you have to login first time by the login details which you have received from gst department through e-mail i.e. when your GST is approved, you get the GST login Details which include Username, Password, and GSTIN (Good and service tax identification number).

• Visit Online GST Portal and Click on “First time login: If you are logging in for the first time, click here to log in”.

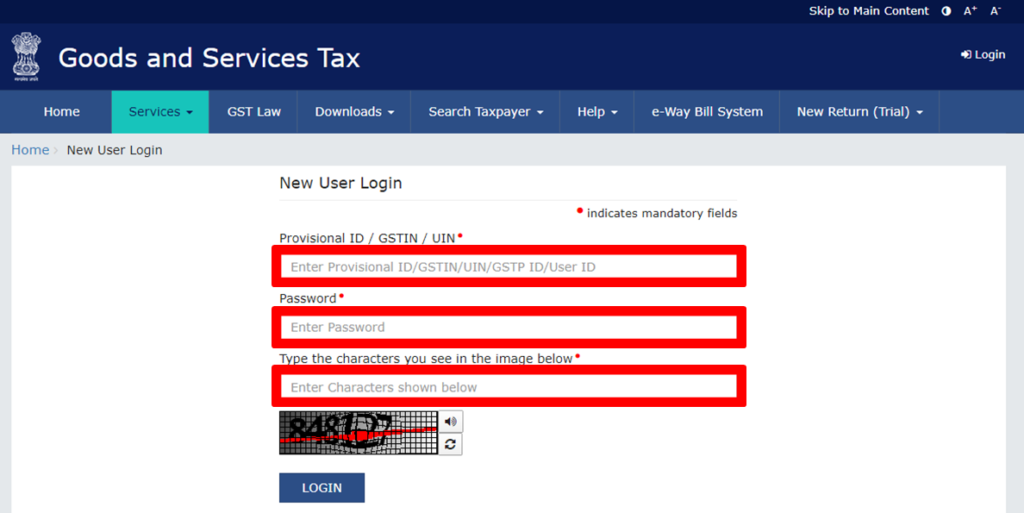

• Now enter the provided “Username” and “Password” from taxpayer registered e-mail id along with the correct “Captcha”

- Once you log in, it will ask to create new username and password for logging in gst portal for next time.

- After that , when you login with your created username and password in gst portal you will be able to download GST certificate by following steps discuss above.

With these following steps you can download GST Certificate online in pdf format (i.e. soft copy).

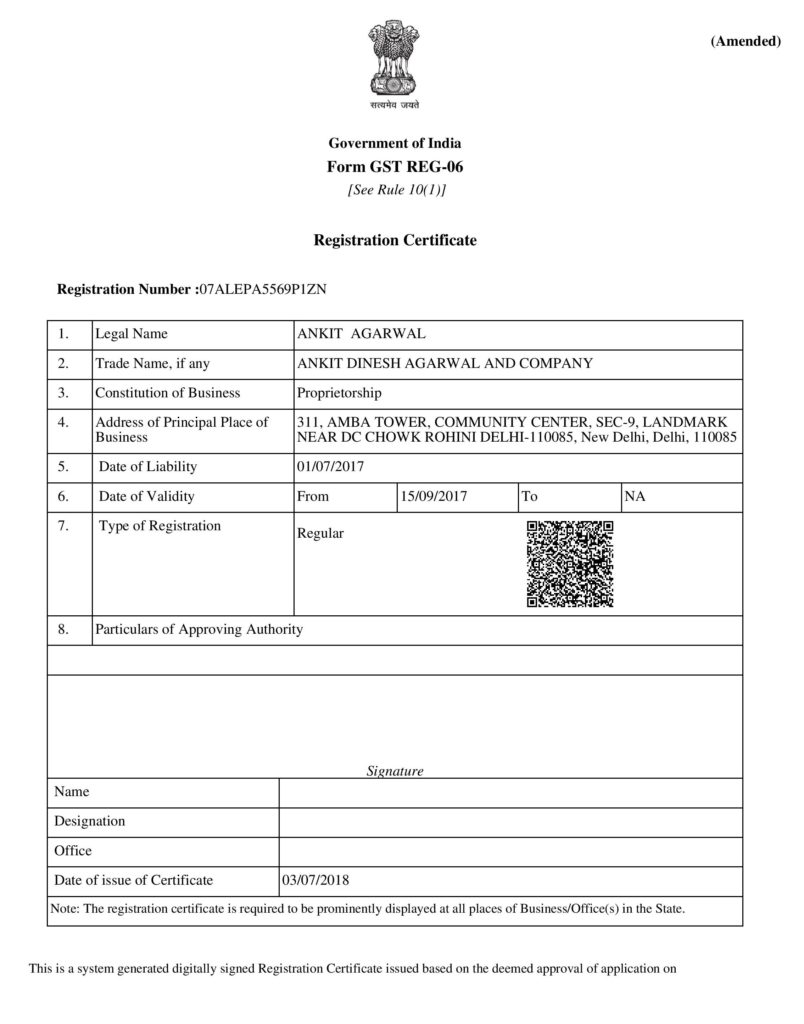

GST Registration Certificate Format – GST REG 06

Below, it is a sample copy of GST Registration Certificate. The GST certificate contains such information as:

The first page includes basic details like :

- Registration Number : The registration number will be given to the registered taxpayer which is also known as GSTIN. GSTIN will be a 15 digit number, the first two digits will be the state code, later 10 digits will be PAN (Permanent Account Number), 13th digit will be The entity number of the same state PAN holder, A “Z” by default at the 14th position, the checksum number will be at the 15th position.

- Legal Name : This shows the legal name of the business holder.

- Trade Name : This shows the trade name of the business if any.

- Constitution of business : This show the type of business, as there are different types of businesses such as Sole proprietorship, Partnership etc.

- Date of liability : On which date the taxpayer becomes liable to registration, the effective date of registration is known as the date of his liability.

- Period of Validity : This section will show the period of validity – which will include the start date and the end date of GST registration certificate validity.

- Types of registration : This shows the type of the taxpayer.

- Signature : Here the DS (Digital Signature) will be displayed here.

- Details of the Approving officer will be mentioned at the end. The details will include the Name, Designation, Jurisdiction Office, Date of issue of the certificate.

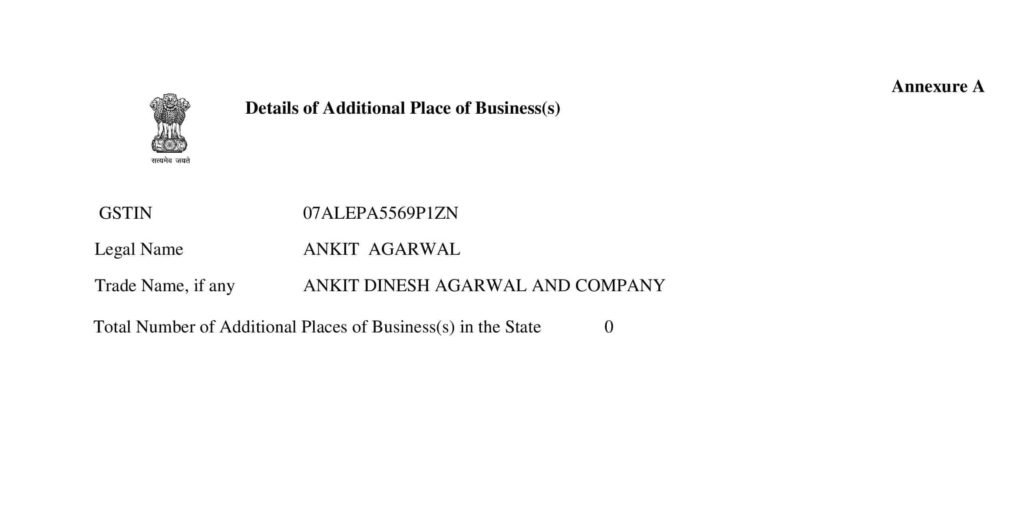

The second page show the details of any additional place of business and it forms the part of “Annexure A“.

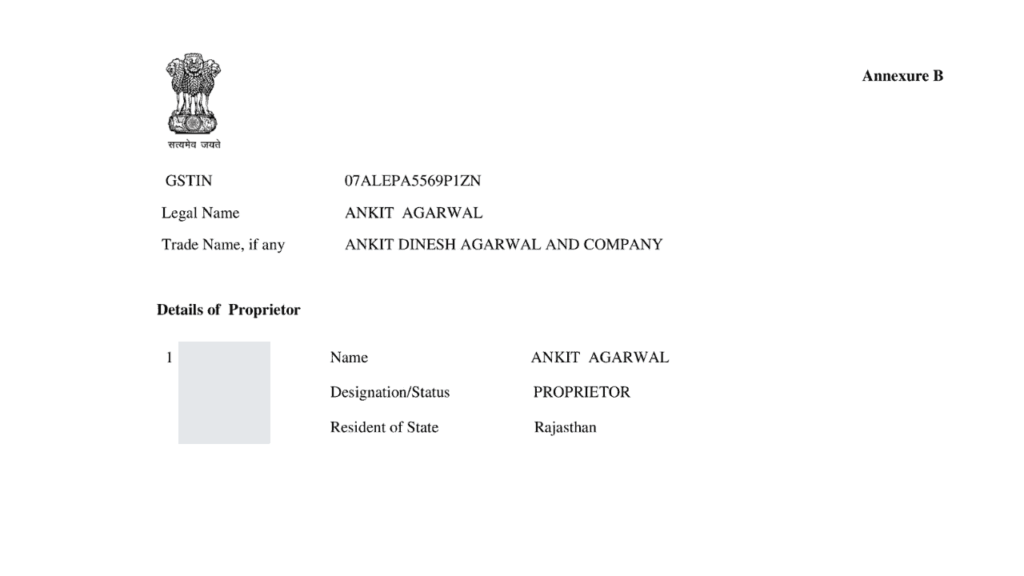

The third page shows the information of the Persons in Charge of the business and it forms the part of “Annexure B“.

It is necessary for every registered taxpayer to have this gst certificate in the business premise available all the time. Also, the person should start issuing GST compliant sales invoices.

Effective Date of Registration

The application for registration must be made within 30 days from the date on which the person becomes liable for registration, or the turnover exceeds the limit laid down in the Goods and Services Tax. Registration of the GST shall take effect from the date on which that entity became liable to be registered under the GST.

Validity of GST Certificate

GST certificate issued to a normal user does not have an expiry date, and therefore it’ll continue to exist until it is surrendered or cancelled by Goods and Services Tax Authority.

But in the case of Casual Taxable person or Non-Resident taxable person, validity is specified to a maximum of 90 days. After such period, validity can be extended or renewed at the option of the entity.

Display Of GST Registration Certificate And Gst Number Rule

- The GST certificate issued to a normal user does not have an expiry date and will therefore continue to exist until it is surrendered or canceled by the Goods and Services Tax Authority.

- However, in the case of a non-resident taxable person or a Casual Taxable person, the period of validity shall be no more than 90 days. After such period, the validity may be extended or renewed at the option of the entity.

Noncompliance of these such disclosures may result in penalties being levied on a default entity.

GST Certificate Verification

The GST number can be verified in just a few seconds. There is the way to verify GSTIN online quickly and it also used if you want to know the registration status of your certificate then, you can check it from GST portal site ie. www.gst.gov.in. Here is how to check the status.

- Visit www.gst.gov.in website

- Click on dropdown of “Search Taxpayer” Tab

- Now You can search your GST certificate status by:

- GSTIN/UIN”

- By PAN

- Search composite Taxpayer

- Click on the any above option which is as applicable to you.

- Enter the GSTIN, PAN or composite taxpayer details.

- enter the captcha shown.

- After entering the correct details, click on the “Search” button

- The system will show your “GSTIN / UIN Status”

Your registration is active, if it is shown by the system as “Active“

What changes can be made to the GST Registration Certificate ?

Amendment in GST Registration Certificate

After registration under the GST, there may be circumstances in which the registered person may require changes to the registration details provided by the registered person. Such changes could be made on account of the change of address , contact number, business details, etc.

In order to make changes to any such information after registration, the taxpayer must submit an application in Form GST REG-14.

There are two types of amendments which include: –

1). Amendments of the Core Fields and

2). Amendment of Non-Core Fields.

1). Amendments of the Core Fields

- The following Changes in respect of constitute the core fields and need to be approved by the proper tax officer.

- Change in the Business Name that does not involve a change in the PAN card.

- Change in the Principal place of Business.

- Change in Additional Places of Business.

- Change in authorized Mobile number or E-mail address, which is used for gst return filing by simple OTP verification.

- Changes in Details of Partners, Directors, Karta etc. who is responsible for carrying day to day activities of the business.

2). Amendment of Non-Core Fields

Fields other than those mentioned above under the Core Fields Act as Non-Core Fields Act as Non-Core Fields. Changes in non-core fields do not require the approval of the tax officer and are self-represented in the registration of the taxpayer.

The process to make changes in GST certificate

In order to change the details referred in the above paragraphs, the entity must follow the following steps:

- Login to the GST portal and go to Services > Registration > Amendment of Registration Core Fields.

- Then Submit the necessary changes in the Form GST REG-14 along with the required documents.

- Application for such amendments can be approved after verification within 15 days, and the procedure for changing information shall be concluded or the application may also be refused by the GST Officer.

- The approval of such amendments will be provided in Form GST REG-15, or the officer may issue a notice in Form GST REG-03 for the purpose of seeking information in the event of refusal.

- If the officer requests further clarification under Form GST REG-03, the entity is required to provide such details in Form REG-04 within 7 days.

- After verification of the above details, the officer may either accept the amendments as indicated in Step 3 or reject the request for amendment by issuing Form GST REG-05.

Are you Looking for GST Registration in India ?

ADA & Co. will guide you in the documentation and other necessary formalities to get GST Registration in India. You can contact us to get our services.

You can also view what are the Documents Required For Proprietorship GST Registration.

Contact Us

If any queries/doubt, feel free to contact us at caadagarwal@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.